What Goes on My Invoice - If I'm Registered for GST & If I'm Not

I know it’s confusing when you start out. There’s lots to do - and you’re trying to keep it all up in the air. So here’s a little info to get you through.

What is GST?

GST stands for Goods and Services Tax and is a tax that is added to most things you buy in Australia.

How do I know when to register for GST?

For a trading business you do not have to register for GST until your turnover hits $75K or more on a rolling basis.

So what this means is your sales for the current month and the previous 11 months OR the current month and the projected turnover for the next 11 months. The exception to this is taxi drivers and ride-sharing drivers who need to register no matter what their turnover. This applies from the first $1 they earn.

If you are close to the turnover threshold for registration, then keep an eye on your sales.

Charging GST on your invoices

GST Commandment No 1 - You cannot charge GST if you are not registered.

GST Commandment No 2 - If you are registered for GST then you must charge GST.

There are exceptions to Commandment No 2 - such as a sale to an overseas customer and if you are unsure please ask your advisor.

When You’re Not Registered for GST

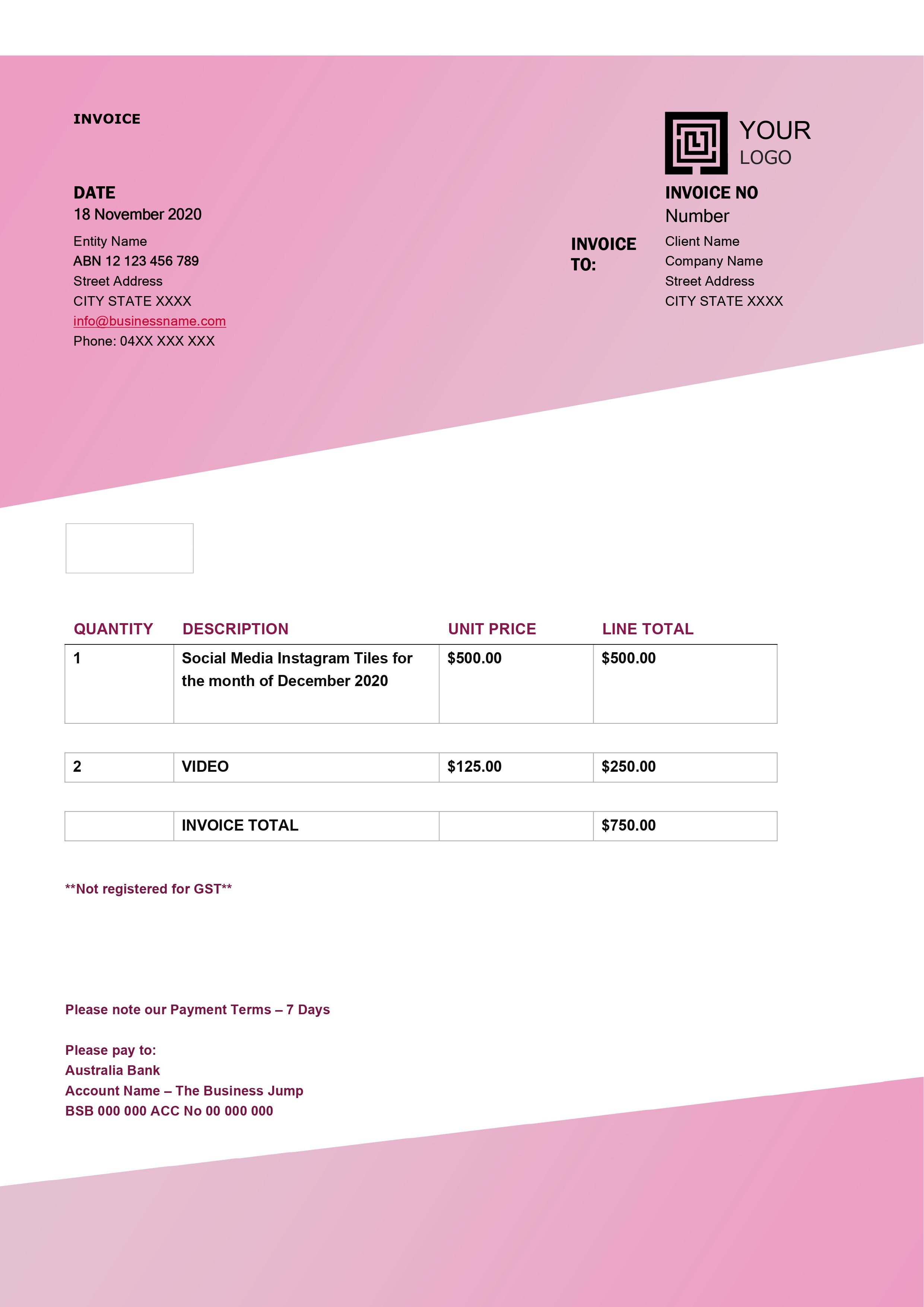

If you run a business that is not registered for goods and services tax (GST), your invoices won’t include a tax component (the GST bit). These are called regular invoices. They should not include the words 'tax invoice' and they'll look like this:

Note the ‘Not registered for GST’

When you are registered for GST, your invoice should look like this, see how it has the words ‘Tax Invoice’ in the top left hand corner:

Note the GST components and Total Price includes GST

Tax invoices must include at least seven pieces of information:

1. that the document is intended to be a tax invoice

2. the seller's identity

3. the seller's Australian business number (ABN)

4. the date the invoice was issued

5. a brief description of the items sold, including the quantity (if applicable) and the price

6. the GST amount (if any) payable – this can be shown separately or, if the GST amount is exactly one-eleventh of the total price, such as a statement which says 'Total price includes GST'

7. the extent to which each sale on the invoice is a taxable sale (that is, the extent to which each sale includes GST).

More info here at the ATO website.

So my tips when you create your own invoices:

Make it easy to read

Make it easy for people to pay you

Include your ABN (and make sure it’s the correct one)

It’s as simple as that.

For more help, grab a copy of our eBook here or book in a consult with me